How To Calculate 20 Down Payment On A House

The payment is principal and interest only. This includes your down payment closing costs home appraisal and home inspection.

Mortgage Payment Calculator For Winnipeg House And Condo Buyers Mortgage Payment Calculator Mortgage Payment Mortgage Calculator

We have built local datasets so we can calculate exactly what closing costs will.

How to calculate 20 down payment on a house. Down payment The amount of money you pay up front to obtain a mortgage. It will also display the loan EMIs on a car loan or a home loan. We recommend a down payment of 20.

With 20 down youll have a better chance of getting approved for a loan. Fortunately the same formula is used with some minor revisions. Therefore it is more useful to know what the monthly or quarterly payment is rather than simply the annual payment.

Whether you plan to put down 20 or 35 NerdWallet will help you see how to get there. PMI typically costs between 05 to 1 of the entire loan amount. There are a variety of different loan options that allow for a low down payment.

Using this example youd finance 100000 with a 15. The idea that buyers need to put at least 20 percent down on a home isnt true. How does Down Payment Calculators work.

Savings are most evident when we compare the total interest costs. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. The home buyer may pay 5 to 25 of the total price of the home upfront while taking out a mortgage from a bank or other financial.

Get the best deals on Car Loan at CarDekho. On a 5 percent 30-year mortgage that higher down payment means paying 9662789 less over the life of the loan -- 50000 in less principal repayment plus a total of 4662789 less interest. Most home loans require a down payment of at least 3.

But with 3 down your monthly payment decreases to 140145 while a 5 down lowers it to 137891. We assume a 30-year fixed mortgage term. Here are some common options.

As an example for a 250000 home a down payment of 35 is 8750 while 20 is 50000. Use our Car Loan Calculator to check monthly EMI on the basis of car price down payment interest rate loan tenure. Or if you qualify for a loan with a lower down payment requirement you may still need to come up with thousands of dollars.

For example you want to buy a house for Rs 5000000. The minimum down payment in Canada is 5. You would make a down payment of 20 or Rs 5000000 02 Rs 1000000.

To compensate for the risk of this low down payment however the borrower is required to pay for private mortgage insurance or PMI when they put less than 20 percent down. Heres how to estimate each. Save more than 96000 long-term.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. PMI is an extra fee added to your mortgage to protect your lender in case you stop making payments. The mortgage principal is 400000.

The amount of money you spend upfront to purchase a home. You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options. Options for putting down less than 20 percent.

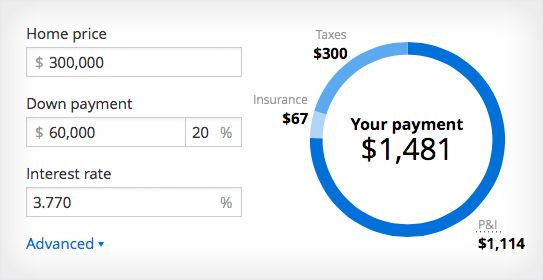

A common example of a down payment is down payment on a house. To get the total monthly payment for down payments below 20 add in your property taxes homeowners insurance and private mortgage insurance PMI. Thats 60000 on a 300000 home.

Mortgage Type Loan Limits. For down payments of less than 20 home buyers are required to purchase mortgage default insurance commonly referred to as CMHC insurance. How much should I save for a down payment on a house.

Some loans like VA loans and some USDA loans allow zero down. Understand the reason to calculate periodic payments on a loan. In general most homebuyers should aim to have 20 of their desired home price saved before applying for a mortgage.

While making a larger down payment has benefits its not uncommon to make a down payment that is less than 20 percent of the purchase price. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Often lenders require that you make monthly or quarterly payments.

The down payment calculator will calculate the down payment you must make before you take the loan. A 20 down payment also allows you to avoid paying private mortgage insurance on your loan. Most lenders are looking for 20 down payments.

For example if you have 25000 saved for a down payment the maximum amount you could spend on a home would be 125000 25000 20. For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the bank to complete the purchase. And youll earn a better.

Whether you plan to do it yourself or hire a pro its a good idea to estimate the costs of painting your house before you start. Saving for a down payment The first step toward your dream home is saving for a down payment. For example a 3 down payment on a 250000 home is still 7500.

This gets you out of paying for something called private mortgage insurance PMI. Doubling a down payment on a 500000 loan from 10 percent to 20 percent means paying an extra 50000 up front. Often a down payment for a home is expressed as a percentage of the purchase price.

If youre coming up short with the funds for a down payment you may be wondering if its possible to cover the cost of a down payment with a loan. Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20. Up 20 percent of your house budget but most first-time buyers put down less than 10 percent.

Paying 3 down saves you 3381 per month and a 5 down saves you 5635 per month. It is important to remember that a down payment only makes up one upfront payment during a home purchase even though it is often the most substantial. Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment.

To calculate the price per square foot of painting a house youll need to start by. We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. Between 2 and 5 percent of your total house budget.

We use live mortgage data to calculate your mortgage payment. Painting a house is a big job. If you buy a 200000 house your private mortgage insurance will cost roughly 2000 annually or 14000 over the course of seven years.

In reality the minimum down payment for a house can be much lower.

Home Affordability Calculator Mortgage Amortization Calculator Mortgage Calculator Mortgage Loan Calculator

Getting A Tax Refund Consider Using It For Your Down Payment Forza Real Estate Money Saving Strategies Tax Refund Buying Your First Home

Purchasing A Home With Less Than 20 Down Payment Will You Need Mortgage Insurance Mi Mortgage Tips Real Estate Tips Buying First Home

Home Loan Deposit Calculator Home Loans Home Improvement Loans Home Renovation Loan

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

What You Need To Know About The Mortgage Process Infographic Mortgage Infographic Mortgage Process Mortgage Tips

Mortgage Calculator Home Loan Calculator With Pmi Zillow Mortgage Payment Calculator Mortgage Estimator Free Mortgage Calculator

Pin On Mortgage Oayment Calculator

Mortgage Points Calculator Mls Mortgage Amortization Schedule Mortgage Calculator Mortgage

Mortgage Calculate App Online Mortgage Mortgage Loans Mortgage Loan Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

What You Need To Know About The Mortgage Process The New Door Group Mortgage Process Mortgage Payment Mortgage

Down Payment On A House It Doesn T Have To Be 20 Percent Home Buying House Down Payment How To Memorize Things

Down Payment Calculator Buying A House Free Mortgage Calculator House Down Payment Mortgage Amortization Calculator

Saving For A Downpayment On A House Buying First Home First Home Buyer Buying Your First Home

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator House Down Payment Mortgage Loan Calculator

Why 20 Is An Ideal Down Payment On A Home Down Payment Home Mortgage Home Buying Tips

Simple Steps To Know Your Monthly Mortgage Payment And Produce A Complete Payment By Payment Mortg Amortization Schedule Mortgage Calculator Mortgage Payment

Posting Komentar untuk "How To Calculate 20 Down Payment On A House"